When starting a new business, the initial investment is a crucial factor to consider. This includes the costs associated with setting up the business, such as securing a location, purchasing equipment, hiring staff, and covering legal and insurance fees. It’s important to carefully plan and budget for these expenses to ensure the business has a strong foundation for success.

One of the major components of the initial investment is securing a suitable location for the business. This may involve purchasing or leasing a commercial space, depending on the nature of the business. The cost of the location will vary depending on factors such as size, location, and local market conditions. Additionally, there may be costs associated with renovating or customizing the space to fit the needs of the business.

Another significant expense in the initial investment is purchasing equipment and supplies necessary for the operation of the business. This can include items such as machinery, computers, furniture, and inventory. The cost of equipment will depend on the type of business and its specific needs. It’s important to carefully research and compare prices to ensure that the business is getting the best value for its investment.

Key Takeaways

- Initial investment for starting a business includes costs such as permits, licenses, and initial inventory.

- Equipment costs can vary depending on the type of business, but should be budgeted for in the initial investment.

- Rent and utilities are ongoing expenses that need to be factored into the business budget.

- Staffing and training costs should be considered, including wages, benefits, and any necessary training programs.

- Marketing and advertising are essential for attracting customers and should be budgeted for in the initial investment and ongoing expenses.

Equipment Costs

Equipment costs are a significant consideration for any business, as they can have a major impact on the overall budget and operational efficiency. Depending on the nature of the business, equipment costs can vary widely and may include items such as machinery, computers, vehicles, and specialized tools. It’s important to carefully assess the specific needs of the business and invest in high-quality equipment that will support its operations.

When budgeting for equipment costs, it’s important to consider both the initial purchase price as well as ongoing maintenance and repair expenses. Investing in reliable and durable equipment can help minimize long-term costs and reduce the risk of unexpected breakdowns or downtime. Additionally, businesses may also need to budget for training employees on how to properly use and maintain equipment to ensure safety and efficiency.

In some cases, businesses may also consider leasing equipment as an alternative to purchasing outright. Leasing can help spread out the cost of equipment over time and may provide flexibility in upgrading to newer models as technology advances. However, it’s important to carefully review lease terms and consider the long-term financial implications before making a decision.

Rent and Utilities

Rent and utilities are ongoing expenses that businesses must budget for when operating out of a physical location. The cost of rent will depend on factors such as location, size, and local market conditions. It’s important to carefully consider these factors when selecting a location for the business to ensure that it is financially sustainable.

In addition to rent, businesses must also budget for utilities such as electricity, water, heating, and cooling. These costs can vary depending on factors such as usage, local rates, and the energy efficiency of the building. Implementing energy-saving measures and investing in efficient appliances can help reduce utility costs over time.

When budgeting for rent and utilities, it’s important to consider potential fluctuations in costs and plan for contingencies. Additionally, businesses should carefully review lease agreements to understand any additional fees or responsibilities related to maintenance and repairs. By carefully managing rent and utility expenses, businesses can help ensure that they remain financially stable and can allocate resources to other areas of operation.

Staffing and Training

| Metrics | Data |

|---|---|

| Employee Turnover Rate | 12% |

| Training Hours per Employee | 40 hours |

| Staffing Cost per Employee | 5,000 |

Staffing and training are essential components of running a successful business, and they are also significant ongoing expenses that must be carefully managed. When budgeting for staffing costs, businesses must consider factors such as wages, benefits, payroll taxes, and potential overtime expenses. It’s important to carefully assess the specific needs of the business and create a staffing plan that supports operational efficiency while remaining financially sustainable.

In addition to wages and benefits, businesses must also budget for training expenses to ensure that employees have the skills and knowledge necessary to perform their roles effectively. This may include investing in formal training programs, workshops, or on-the-job training opportunities. By providing ongoing training and development opportunities, businesses can help improve employee retention and performance.

When hiring new employees, businesses must also consider recruitment costs such as advertising, background checks, and potential relocation expenses. It’s important to carefully assess these costs when creating a staffing budget to ensure that they are aligned with the overall financial goals of the business. By carefully managing staffing and training expenses, businesses can help create a positive work environment while maintaining financial stability.

Marketing and Advertising

Marketing and advertising are essential components of promoting a business and attracting customers, but they can also be significant ongoing expenses that must be carefully managed. When budgeting for marketing and advertising costs, businesses must consider factors such as branding, digital marketing, traditional advertising channels, and promotional events. It’s important to carefully assess these expenses to ensure that they align with the overall marketing strategy and financial goals of the business.

In addition to external marketing efforts, businesses must also consider internal marketing expenses such as signage, packaging, and promotional materials. These costs can vary depending on factors such as design complexity, materials used, and quantity ordered. It’s important to carefully assess these expenses to ensure that they support the overall branding and marketing efforts of the business.

When creating a marketing and advertising budget, businesses should also consider potential fluctuations in costs and plan for contingencies. Additionally, it’s important to regularly review marketing performance metrics to assess the return on investment from different marketing channels and adjust strategies as needed. By carefully managing marketing and advertising expenses, businesses can help maximize their reach and attract new customers while remaining financially sustainable.

Insurance and Legal Fees

Insurance and legal fees are essential components of protecting a business from potential risks and liabilities, but they can also be significant ongoing expenses that must be carefully managed. When budgeting for insurance costs, businesses must consider factors such as property insurance, liability insurance, workers’ compensation, and professional liability coverage. It’s important to carefully assess these expenses to ensure that they provide adequate protection while remaining financially sustainable.

In addition to insurance costs, businesses must also budget for legal fees related to ongoing compliance, contracts, intellectual property protection, and potential litigation. Legal fees can vary depending on factors such as complexity of legal matters, hourly rates of legal professionals, and potential court fees. It’s important to carefully assess these expenses to ensure that they align with the overall legal needs of the business.

When creating an insurance and legal fees budget, businesses should also consider potential fluctuations in costs and plan for contingencies. Additionally, it’s important to regularly review insurance coverage and legal contracts to ensure that they remain up-to-date with changing business needs and regulations. By carefully managing insurance and legal fees expenses, businesses can help protect themselves from potential risks while remaining financially stable.

Ongoing Maintenance and Supplies

Ongoing maintenance and supplies are essential components of running a successful business, but they can also be significant ongoing expenses that must be carefully managed. When budgeting for maintenance costs, businesses must consider factors such as routine maintenance of equipment, building repairs, landscaping services, and cleaning services. It’s important to carefully assess these expenses to ensure that they support operational efficiency while remaining financially sustainable.

In addition to maintenance costs, businesses must also budget for supplies necessary for day-to-day operations such as office supplies, inventory restocking, packaging materials, and cleaning products. These costs can vary depending on factors such as usage rates, supplier prices, and potential waste reduction efforts. It’s important to carefully assess these expenses to ensure that they support operational needs while remaining financially sustainable.

When creating a maintenance and supplies budget, businesses should also consider potential fluctuations in costs and plan for contingencies. Additionally, it’s important to regularly review maintenance schedules and supply usage patterns to identify potential cost-saving opportunities. By carefully managing ongoing maintenance and supplies expenses, businesses can help ensure operational efficiency while remaining financially stable.

In conclusion, starting a new business involves careful planning and budgeting for various expenses related to initial investment, equipment costs, rent and utilities, staffing and training, marketing and advertising, insurance and legal fees, as well as ongoing maintenance and supplies. By carefully assessing these expenses and creating comprehensive budgets that align with the overall financial goals of the business, entrepreneurs can help ensure that their businesses have a strong foundation for success while remaining financially sustainable in the long run.

If you’re considering starting a laser hair removal business, you may be wondering about the costs involved. From purchasing equipment to training staff, there are several factors to consider. In a related article on inlaserhairremoval.com, you can find valuable insights into the expenses associated with laser hair removal training. Understanding these costs can help you make informed decisions as you embark on this business venture.

FAQs

What are the typical costs involved in starting a laser hair removal business?

The costs involved in starting a laser hair removal business can vary depending on factors such as location, equipment, licensing, and marketing. However, typical costs may include equipment purchases (laser machines, cooling systems, etc.), lease or purchase of a commercial space, licensing and permits, insurance, marketing and advertising expenses, and staff salaries.

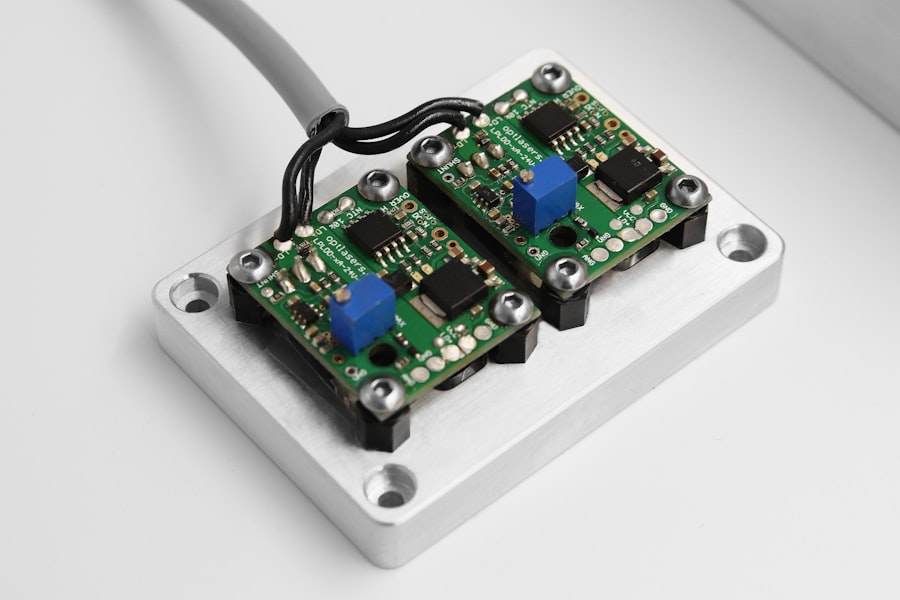

How much does laser hair removal equipment cost?

The cost of laser hair removal equipment can vary widely depending on the brand, model, and features. Entry-level machines can start at around $50,000, while more advanced models can cost upwards of $150,000. Additionally, cooling systems and other accessories may also need to be purchased, adding to the overall equipment cost.

What are the ongoing expenses of running a laser hair removal business?

In addition to the initial startup costs, ongoing expenses of running a laser hair removal business may include rent or mortgage payments for the commercial space, utilities, equipment maintenance and repairs, supplies (such as cooling gels and disposable items), staff salaries, marketing and advertising costs, and insurance premiums.

Are there any regulatory or licensing costs associated with starting a laser hair removal business?

Yes, there are regulatory and licensing costs associated with starting a laser hair removal business. These may include obtaining a medical director or supervising physician, obtaining a laser operating permit, and meeting any state or local regulations for operating a medical or aesthetic business. Costs for these requirements can vary depending on the location and specific regulations.

What are some potential additional costs to consider when starting a laser hair removal business?

Additional costs to consider when starting a laser hair removal business may include professional liability insurance, business insurance, legal fees for setting up the business structure, continuing education and training for staff, and potential costs for additional services or equipment to offer a wider range of treatments.