When considering the initial investment for a large-scale purchase such as industrial equipment or machinery, it is crucial to take into account all the associated costs. The initial investment includes the purchase price of the equipment itself, as well as any additional costs such as installation, training, and setup. It is important to carefully evaluate the total cost of ownership, including any potential hidden costs, to ensure that the investment is financially viable in the long run.

In addition to the purchase price, it is important to consider the potential for future upgrades or modifications to the equipment. This can include software updates, hardware upgrades, or additional components that may be necessary to keep the equipment running at peak performance. By understanding the initial investment and potential future costs, businesses can make informed decisions about whether the investment is financially feasible and sustainable in the long term.

Key Takeaways

- Initial investment includes the cost of purchasing the technology and any necessary infrastructure.

- Factors affecting the cost include the size and complexity of the technology, as well as any additional features or customization.

- Maintenance and operational costs include regular upkeep, repairs, and energy consumption.

- Financing options and leasing can help spread out the initial investment over time and reduce upfront costs.

- Return on investment should be considered in terms of cost savings, increased efficiency, and potential revenue generation.

Factors Affecting the Cost

Several factors can affect the cost of industrial equipment and machinery. One of the most significant factors is the size and complexity of the equipment. Larger and more complex machinery typically comes with a higher price tag due to the increased materials and labor required for manufacturing. Additionally, specialized equipment that is designed for specific industries or applications may also come with a higher cost due to the research and development involved in creating such specialized machinery.

Another factor that can affect the cost of industrial equipment is the level of automation and technology involved. Equipment that incorporates advanced automation and cutting-edge technology may come with a higher initial investment, but it can also offer increased efficiency and productivity, leading to long-term cost savings. Additionally, the brand and reputation of the manufacturer can also impact the cost of industrial equipment, as well-known and reputable brands may command a premium price for their products.

Maintenance and Operational Costs

In addition to the initial investment, businesses must also consider the ongoing maintenance and operational costs associated with industrial equipment. Regular maintenance is essential to keep equipment running smoothly and efficiently, and it can help to prevent costly breakdowns and repairs. Businesses must budget for routine maintenance tasks such as oil changes, filter replacements, and inspections, as well as any potential repairs or replacements that may be necessary over time.

Operational costs such as energy consumption, fuel, and consumables must also be factored into the overall cost of ownership. Energy-efficient equipment may come with a higher initial investment but can offer significant long-term savings on operational costs. Businesses must carefully evaluate the total cost of ownership, including maintenance and operational costs, to determine the true financial impact of investing in industrial equipment.

Financing Options and Leasing

| Financing Options | Leasing |

|---|---|

| Bank Loan | Operating Lease |

| Line of Credit | Financial Lease |

| Equipment Financing | Capital Lease |

| Invoice Financing |

Businesses have several financing options available to help cover the initial investment in industrial equipment. Traditional bank loans, equipment financing, and leasing are common options that can help spread out the cost of the investment over time. Equipment financing allows businesses to borrow funds specifically for the purchase of equipment, with the equipment itself serving as collateral for the loan. Leasing offers businesses the opportunity to use equipment without having to purchase it outright, making it a more flexible option for businesses with limited capital.

When considering financing options, businesses must carefully evaluate the terms and interest rates to ensure that they are getting the best possible deal. It is important to consider the impact of financing on cash flow and overall financial stability, as well as any potential tax benefits or incentives that may be available for investing in new equipment.

Return on Investment

Calculating the return on investment (ROI) for industrial equipment involves evaluating both the costs and benefits associated with the investment. Businesses must consider not only the initial investment but also the potential cost savings and revenue generation that can result from investing in new equipment. Increased productivity, efficiency, and quality can all contribute to a positive ROI for industrial equipment.

Businesses must also consider the potential for future growth and expansion that may result from investing in new equipment. By carefully evaluating the potential ROI, businesses can make informed decisions about whether investing in new equipment is financially viable and beneficial in the long run.

Cost Comparison with Other Technologies

When considering an investment in industrial equipment, businesses must also compare the costs with other available technologies or alternatives. This can include evaluating different brands and models of equipment, as well as considering alternative technologies that may offer similar benefits at a lower cost. Businesses must carefully evaluate the features, capabilities, and long-term costs of different technologies to determine which option offers the best value for their specific needs.

It is important to consider not only the upfront costs but also the potential long-term savings and benefits that different technologies can offer. By conducting a thorough cost comparison, businesses can make informed decisions about which technology or equipment offers the best overall value for their specific requirements.

Budgeting and Planning for the Purchase

Budgeting and planning for a large-scale purchase such as industrial equipment requires careful consideration of all associated costs and potential financial impacts. Businesses must carefully evaluate their current financial position and cash flow to determine how much they can afford to invest in new equipment. It is important to consider not only the initial investment but also any potential financing costs, maintenance expenses, and operational costs that may arise over time.

In addition to budgeting for the initial purchase, businesses must also consider any potential training or setup costs that may be necessary to integrate new equipment into their operations. By carefully planning and budgeting for the purchase of industrial equipment, businesses can ensure that they are making a sound financial decision that aligns with their long-term goals and objectives.

If you’re considering investing in a laser hair removal machine, you may also be interested in learning about the cost of the procedure and its benefits. In a related article on full body permanent laser hair removal, you can explore the advantages of this long-term solution and gain insights into the potential costs involved. Understanding the financial commitment associated with laser hair removal can help you make an informed decision about whether it’s the right choice for you.

FAQs

What factors can affect the cost of a laser machine?

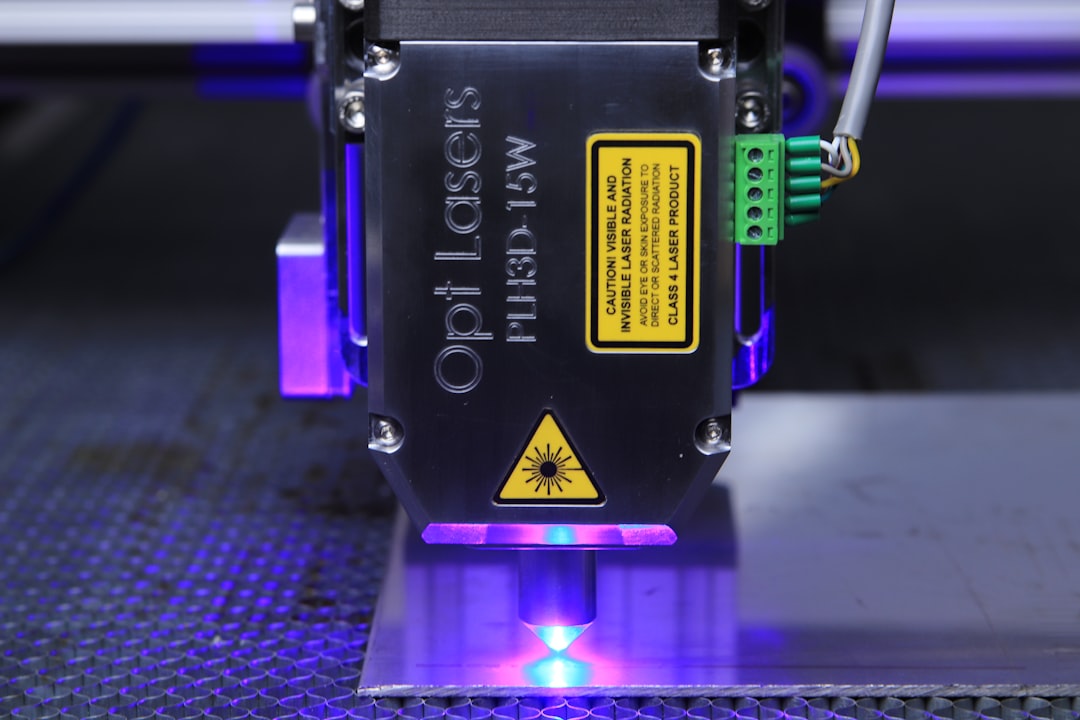

Factors that can affect the cost of a laser machine include the type of laser (CO2, fiber, etc.), the power of the laser, the size of the machine, the brand, and additional features such as automation and software.

What is the price range for a laser machine?

The price range for a laser machine can vary widely depending on the factors mentioned above. Generally, small desktop laser machines can start at around $2,000, while larger industrial-grade machines can cost upwards of $100,000 or more.

Are there additional costs associated with owning a laser machine?

Yes, there are additional costs to consider when owning a laser machine, such as maintenance, replacement parts, consumables (like laser tubes and lenses), and any necessary safety equipment.

Can I finance a laser machine purchase?

Yes, many manufacturers and distributors offer financing options for purchasing a laser machine. This can help spread out the cost over time and make it more manageable for businesses.

Are there any ongoing costs associated with operating a laser machine?

Yes, there are ongoing costs associated with operating a laser machine, such as electricity, gas (for CO2 lasers), and any consumables or replacement parts that may be needed over time.