When considering starting a business, it’s crucial to understand the initial investment required. This includes the costs associated with securing a location, purchasing or leasing equipment, obtaining necessary permits and licenses, and any other startup expenses. For example, if you’re looking to open a restaurant, you’ll need to factor in the cost of leasing a space, renovating the interior, purchasing kitchen equipment, and obtaining health and safety certifications. It’s important to conduct thorough research and create a detailed business plan to accurately estimate the initial investment required.

In addition to physical costs, it’s also important to consider the intangible expenses associated with starting a business. This may include hiring a lawyer or accountant to assist with legal and financial matters, investing in marketing and advertising to promote the business, and setting aside funds for unexpected expenses. By thoroughly understanding the initial investment required, entrepreneurs can make informed decisions and secure the necessary funding to launch their business successfully.

Key Takeaways

- Initial investment includes the cost of purchasing or leasing a location, franchise fee, and initial inventory.

- Ongoing costs may include rent, utilities, insurance, and ongoing marketing expenses.

- Royalty and marketing fees are typically a percentage of revenue that goes to the franchisor for support and advertising.

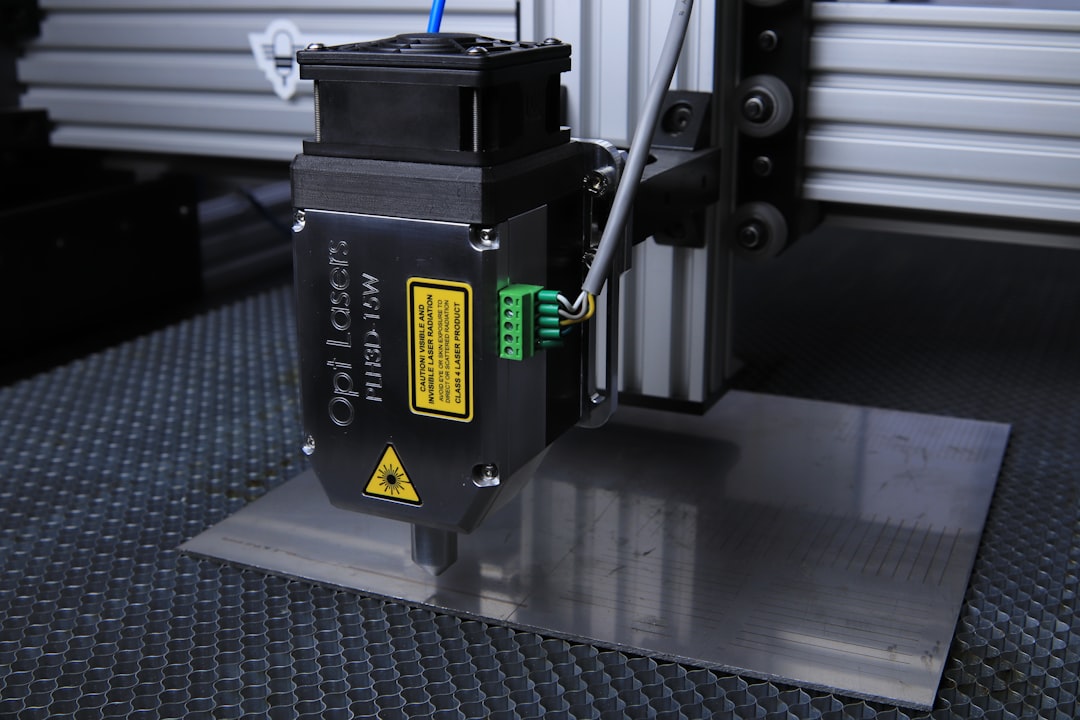

- Equipment and supplies expenses cover the cost of necessary tools, machinery, and inventory.

- Staffing and training costs include wages, benefits, and initial training for employees.

Analyzing Ongoing Costs

Once a business is up and running, it’s essential to analyze the ongoing costs associated with maintaining operations. This includes expenses such as rent or mortgage payments, utilities, insurance, payroll, inventory, and any other recurring costs. It’s important to create a detailed budget that outlines these ongoing expenses to ensure that the business remains financially sustainable in the long term. For example, a retail store will need to budget for monthly rent, electricity, water, and other utility bills, as well as the cost of restocking inventory and paying employee wages.

In addition to fixed costs, it’s also important to consider variable expenses that may fluctuate from month to month. This could include marketing and advertising costs, repairs and maintenance, and any unexpected expenses that may arise. By carefully analyzing ongoing costs, business owners can make informed decisions about pricing, budgeting, and resource allocation to ensure the financial health of their business.

Examining Royalty and Marketing Fees

For entrepreneurs considering franchising opportunities, it’s important to examine the royalty and marketing fees associated with the franchise agreement. Royalty fees are typically paid to the franchisor on a regular basis, often as a percentage of gross sales. These fees are intended to compensate the franchisor for providing ongoing support and resources to franchisees. Additionally, franchisees may be required to contribute to a marketing fund that is used to promote the brand on a national or regional level. It’s important for potential franchisees to carefully review the franchise agreement and understand the specific royalty and marketing fees required.

By examining these fees in detail, entrepreneurs can make informed decisions about whether a particular franchise opportunity is financially viable. It’s important to consider how these fees will impact the overall profitability of the business and whether they are reasonable given the support and resources provided by the franchisor. By carefully examining royalty and marketing fees, entrepreneurs can ensure that they are entering into a franchise agreement that aligns with their financial goals and expectations.

Exploring Equipment and Supplies Expenses

| Category | Expense |

|---|---|

| Office Supplies | 500 |

| Equipment Maintenance | 300 |

| Technology Upgrades | 800 |

For businesses that require specialized equipment or supplies, it’s important to explore the associated expenses in detail. This may include purchasing or leasing equipment such as industrial machinery, vehicles, or technology systems, as well as stocking up on necessary supplies and materials. It’s important to carefully research suppliers and compare prices to ensure that you are getting the best value for your investment. Additionally, it’s important to consider ongoing maintenance and repair costs for equipment to ensure that it remains in good working condition.

In addition to equipment expenses, businesses may also need to budget for office supplies, inventory, packaging materials, and other necessary items. It’s important to create a detailed inventory list and estimate the cost of replenishing supplies on a regular basis. By exploring equipment and supplies expenses thoroughly, businesses can ensure that they have the necessary resources to operate efficiently and effectively.

Considering Staffing and Training Costs

Staffing and training costs are significant expenses for many businesses, particularly those in industries such as retail, hospitality, and healthcare. It’s important to carefully consider the cost of hiring and training employees, including wages, benefits, payroll taxes, and any additional expenses such as uniforms or equipment. Additionally, businesses may need to budget for ongoing training and professional development to ensure that employees have the necessary skills and knowledge to perform their roles effectively.

When considering staffing costs, it’s important to carefully analyze labor needs based on factors such as peak business hours, seasonal fluctuations, and industry standards. This will help businesses determine how many employees they need to hire and budget accordingly. By considering staffing and training costs in detail, businesses can ensure that they have the necessary human resources to operate smoothly while remaining financially sustainable.

Calculating Potential Revenue and Profit

In order to make informed decisions about starting or expanding a business, it’s crucial to calculate potential revenue and profit. This involves conducting market research to understand customer demand, pricing strategies, competition, and other factors that may impact sales. By creating detailed sales projections based on realistic assumptions, entrepreneurs can estimate potential revenue streams and determine whether the business is financially viable.

In addition to revenue projections, it’s important to calculate potential profit by subtracting all expenses from total revenue. This includes both fixed and variable costs such as rent, utilities, payroll, inventory, marketing, and any other operating expenses. By carefully analyzing potential revenue and profit, entrepreneurs can make informed decisions about pricing strategies, cost control measures, and resource allocation to maximize profitability.

Evaluating the Overall Return on Investment

Finally, it’s essential to evaluate the overall return on investment (ROI) when considering starting or expanding a business. This involves comparing the initial investment required with potential revenue and profit to determine whether the business is financially viable in the long term. By conducting a thorough cost-benefit analysis, entrepreneurs can assess the potential risks and rewards associated with their business venture.

In addition to financial considerations, it’s also important to evaluate non-financial factors that may impact the overall ROI. This could include factors such as personal fulfillment, work-life balance, community impact, and long-term growth potential. By evaluating the overall ROI from both financial and non-financial perspectives, entrepreneurs can make informed decisions about whether a particular business opportunity aligns with their goals and values.

In conclusion, understanding the initial investment required, analyzing ongoing costs, examining royalty and marketing fees, exploring equipment and supplies expenses, considering staffing and training costs, calculating potential revenue and profit, and evaluating the overall return on investment are all crucial steps in making informed decisions about starting or expanding a business. By thoroughly researching and analyzing these factors, entrepreneurs can mitigate risks and maximize their chances of success in the competitive business landscape.

If you’re considering investing in a laser hair removal franchise, it’s essential to evaluate the quality of laser hair removal services. Understanding the factors that contribute to effective and safe treatments can make a significant difference in the success of your business. In a recent article by In Laser Hair Removal, they discuss the importance of evaluating the quality of laser hair removal services and provide valuable insights into what to look for when choosing a franchise partner. This article can be found here.

FAQs

What is the average price of a laser hair removal franchise?

The average price of a laser hair removal franchise can vary depending on the brand, location, and specific business model. However, the initial investment for a laser hair removal franchise typically ranges from $150,000 to $300,000.

What factors can affect the price of a laser hair removal franchise?

Several factors can affect the price of a laser hair removal franchise, including the brand reputation, the size and location of the franchise, the equipment and technology used, and the level of support and training provided by the franchisor.

What are the ongoing costs associated with owning a laser hair removal franchise?

In addition to the initial investment, owning a laser hair removal franchise also involves ongoing costs such as royalty fees, marketing fees, equipment maintenance, rent, utilities, and staffing expenses.

Are there financing options available for purchasing a laser hair removal franchise?

Many franchisors offer financing options to help potential franchisees cover the initial investment. Additionally, some banks and financial institutions may offer loans specifically tailored for franchise businesses.

What are the potential returns on investment for a laser hair removal franchise?

The potential returns on investment for a laser hair removal franchise can vary depending on the location, market demand, and the effectiveness of the business operations. However, successful laser hair removal franchises can generate significant revenue and profits over time.